UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box: | ||||

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to §240.14a-12 | |

Stock Yards Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

Stock Yards Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

☐ | Fee paid previously with preliminary materials. | |

☐ |

| |

|

| |

|

| |

|

| |

|

| |

1040 East Main StreetLouisville, Kentucky 40206502.582.2571

March 23, 2018

Dear Shareholder:

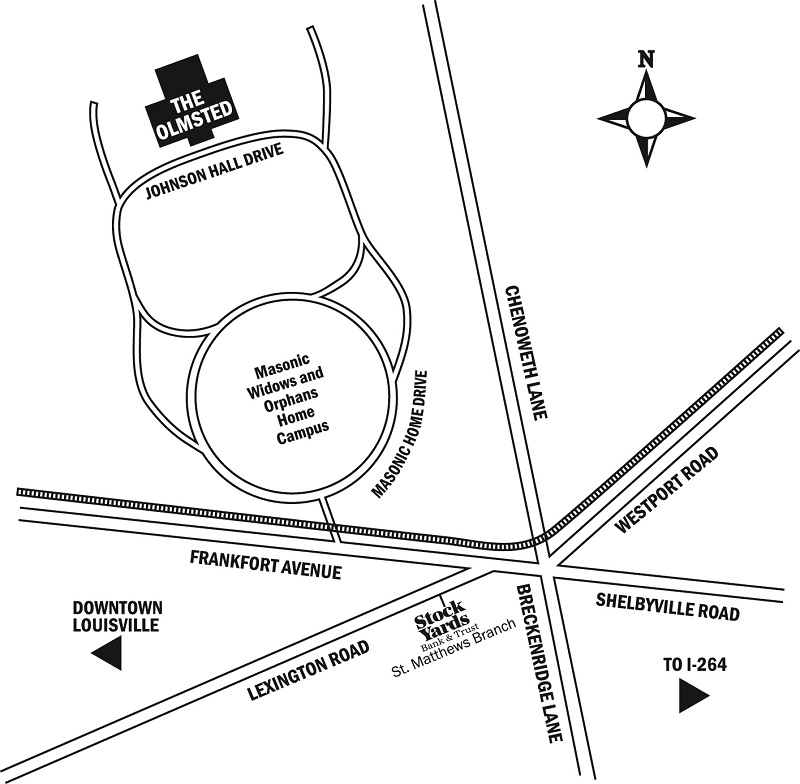

We invite you to attend the 2018 Annual Meeting of Shareholders of Stock Yards Bancorp, Inc., to be held at 10:00 a.m., Eastern Time, on Thursday, April 26, 2018, at The Olmsted, 3701 Frankfort Avenue, Louisville, Kentucky 40206. There is a map on the back cover for your reference.

The enclosed Notice and Proxy Statement contain complete information about matters to be considered at the Annual Meeting, at which we will also review Stock Yards Bancorp’s business and operations. Only shareholders of record on the record date for the meeting and their proxies are entitled to vote at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting of Shareholders, we hope you will vote as soon as possible. You may vote your shares via a toll free number or over the Internet, or by completing, signing and returning the enclosed proxy card in the envelope provided. Instructions regarding each of the three methods of voting are contained in the Proxy Statement.

Sincerely yours,

/s/ David P. Heintzman

David P. Heintzman

Chairman and Chief Executive Officer

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to Be Held on April 26, 2018: The Notice and Proxy Statement and Annual Report are available at http://irinfo.com/sybt/sybt.html.

Stock Yards Bancorp, Inc.

1040 East Main StreetLouisville, Kentucky 40206

NOTICE OF THE2018

2024 ANNUAL MEETING OF SHAREHOLDERS

March 23, 2018 14, 2024

To our Shareholders:

The Annual Meeting of Shareholders of Stock Yards Bancorp, Inc., a Kentucky corporation, will be held on Thursday, April 26, 201825, 2024, at 10:00 a.m., Eastern Time, solely by remote communication in a virtual-only format. The meeting will be accessible on the Internet at www.virtualshareholdermeeting.com/SYBT2024. The Olmsted, 3701 Frankfort Avenue, Louisville, Kentucky 40206 foritems of business to be presented at the Annual Meeting include the following purposes:proposals:

(1) | To elect |

(2) | To |

(3) | To approve a non-binding resolution to approve the compensation of Stock Yards |

(4) | To approve the amendment and restatement of the 2015 Omnibus Equity Compensation Plan, including an increase in the number of shares of Common Stock reserved and available for issuance thereunder; and |

(5) | To transact such other business as may properly come before the meeting. |

The record date for the determination of the shareholders entitled to vote at the meeting or at any adjournment thereof is the close of business on March 5, 2018.1, 2024.

A list of shareholders of record as of the record date and entitled to vote at the Annual Meeting will be made available for inspection by shareholders for any legally valid purpose related to the Annual Meeting (i) at the principal executive offices of Stock Yards Bancorp, beginning five business days prior to the meeting date and (ii) on the virtual shareholder meeting web site on the date of the meeting.

In order to reduce costs and lessen the environmental impact of our Annual Meeting, we are furnishing our proxy materials to shareholders over the Internet. We are mailing a Notice of Internet Availability of Proxy Materials to many of our shareholders instead of paper copies of these materials. The Notice contains instructions on how to access the proxy materials on the Internet, how to vote your shares and how shareholders can request paper copies of these documents, including the Proxy Statement, our 2023 Annual Report and proxy card, if they prefer.

Your vote is important.important. Whether or not you plan to virtually attend the Annual Meeting of Shareholders, we hope you will vote as soon as possible. Please reviewYou may vote your shares electronically using your computer, telephone or mobile device. If you received paper copies of our proxy materials, you may also vote your shares by completing, signing, dating and returning the instructions with respect toenclosed proxy card in the mailing envelope provided. Instructions regarding each of yourthese methods of voting options as describedare contained in the accompanying Proxy Statement. The Board of Directors

Thank you for your support of Stock Yards Bancorp appreciates your cooperation in directing proxies to vote at the meeting.Bancorp. If your schedule permits, I hope you will join me atus via the meeting.

live webcast.

By Order of the Board of Directors | |||

/s/ | |||

| |||

James A. Hillebrand | |||

| Chairman and Chief Executive Officer | |||

WE URGE SHAREHOLDERS TO VOTE AS SOON AS POSSIBLE

Stock Yards Bancorp, Inc.

1040 East Main StreetLouisville, Kentucky 40206

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENTFOR THE 2018 ANNUAL MEETING OF SHAREHOLDERSHIGHLIGHTS

This summary highlights information contained elsewhere in this Proxy Statement about the Annual Meeting and is not complete. We encourage you to read the entire Proxy Statement before voting your shares at the meeting. For complete information about our performance and financial results for 2023, please review our Annual Report on Form 10-K which accompanies this Proxy Statement.

GeneralAnnual Meeting Information about

Date and Time: | Virtual Location: | Record Date: |

Thursday, April 25, 2024 10:00 a.m., Eastern Time | www.virtualshareholdermeeting.com/SYBT2024 | March 1, 2024 |

Voting Matters and Board Recommendations

Proposal | Board Recommendation | Page Reference | |

1: | Election of directors | ✔ FOR all nominees | 16 |

2: | Ratification of our independent auditor for 2024 | ✔ FOR | 26 |

3: | Advisory vote on executive compensation | ✔ FOR | 26 |

4: | Approval of the amendment and restatement of our 2015 Omnibus Equity Compensation Plan | ✔ FOR | 27 |

How to Vote Your Shares

You may vote your shares using one of the following methods:

|  |  |  |  |

www.proxyvote.com | Call toll-free | Scan the QR Code on your proxy card (above QR code is not active) | Complete, sign, date and return the enclosed proxy card | Attend and vote online at: www.virtualshareholdermeeting.com/SYBT2024 |

YOUR VOTE IS IMPORTANT!

PLEASE CAST YOUR VOTE PROMPTLY

Attending the Virtual Annual Meeting

Our 2024 Annual Meeting will be held in a virtual-only format via a live webcast. You will be able to attend the meeting online, vote your shares electronically and submit questions either before or during the meeting by following the information and instructions provided in this Proxy Statement. To attend the Annual Meeting online, simply visit the virtual meeting website at Why have Iwww.virtualshareholdermeeting.com/SYBT2024. In order to be admitted to the meeting, you will need to enter the 16-digit control number located on your Notice of Internet Availability of Proxy Materials or email notice or, if you received these materials?a paper copy of the proxy materials, your proxy card or voting instruction form. For more information about joining the online meeting, go to page 6.

We are mailing this

| Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to Be Held on April 25, 2024: The Notice and Proxy Statement and Annual Report are available at www.proxyvote.com and on the investor relations page of the Company’s website at https://stockyardsbancorp.q4ir.com. |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

About This Proxy Statement

This Proxy Statement is being furnished to the shareholders of Stock Yards Bancorp, Inc. in connection with the solicitation by its Board of Directors of proxies to be used at the 2024 Annual Meeting of Shareholders. This Proxy Statement includes information regarding the matters to be acted upon at the 2024 Annual Meeting and certain other information required by the Securities and Exchange Commission, or “SEC”, and the accompanying proxyrules of the Nasdaq Stock Market, or “Nasdaq”. This Proxy Statement is first being sent or made available to shareholders on or about March 23, 2018. The proxy is solicited by14, 2024.

Throughout this Proxy Statement, unless the Board of Directors ofcontext otherwise requires, the terms “Stock Yards Bancorp”, “Bancorp”, “the Company”, “we”, “us” or “our” all refer to Stock Yards Bancorp, Inc. (referred to throughout this Proxy Statement as “Stock Yards Bancorp”, “Bancorp”, “the Company” or “we” or “our”) in connection with our Annual Meeting of Shareholders that will take place on Thursday, April 26, 2018. We invite you to attend the Annual Meeting and request you to vote on the proposals described in this Proxy Statement.

What am I voting on?

|

|

|

|

|

|

Where can I find more information about these voting matters?

|

|

|

|

|

|

What is the relationship of Stock Yards Bancorpits direct and Stock Yards Bank & Trust Company?

Stock Yards Bancorp is the holding company forindirect wholly-owned subsidiaries, including Stock Yards Bank & Trust Company, (referredwhich we refer to throughoutin this Proxy Statement as “the Bank”)“the Bank”. Stock Yards Bancorp owns 100% of Stock Yards Bank & Trust Company. Because Stock Yards Bancorp has no significant operations of its own, its business and that of Stock Yards Bank & Trust Company are essentially the same.

Proxy Materials

Why have I received these materials?

We have made these proxy materials available to you over the Internet or mailed printed copies to you in connection with our 2024 Annual Meeting of Shareholders, which will be held on Thursday, April 25, 2024, at 10:00 a.m., Eastern Time. As a shareholder, you are invited to participate in the meeting via live webcast and vote on the matters described in this Proxy Statement.

What is included in the proxy materials?

These proxy materials include:

● | The Notice of the 2024 Annual Meeting of Shareholders; |

● | This Proxy Statement for the Annual Meeting; and |

● | Our 2023 Annual Report, which includes our Annual Report on the Form 10-K for the year ended December 31, 2023. |

If you received a paper copy of these materials by mail, the proxy materials also include a proxy card or a voting instruction form for the Annual Meeting. If you received a Notice of Internet Availability of Proxy Materials, which we refer to as the “Notice”, instead of a paper copy of the proxy materials, see “How can I access the proxy materials and vote my shares”below for information regarding how you can vote your shares.

What is a proxy?

We are soliciting your proxy to vote the shares of the Company’s common stock that you own at the Annual Meeting. A proxy is your designation of another person to vote stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. When you designate a proxy, you may also direct the proxy how to vote your shares. James A. Hillebrand, the Company’s Chairman and Chief Executive Officer, and Philip S. Poindexter, the Company’s President, have been designated as the proxies to cast the votes of Bancorp’s shareholders at the Annual Meeting. The proxies will vote your shares according to the instructions you provide on the proxy card or by telephone, mobile device or over the Internet.

Information About Delivery of Proxy Materials

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the full set of proxy materials?

This year, we are using the SEC rule that allows companies to furnish their proxy materials over the Internet. By doing so, we reduce costs and lessen the environmental impact of our proxy solicitation. As a result, we are mailing the Notice to many of our shareholders instead of a paper copy of the proxy materials. All shareholders receiving the Notice will have the ability to access the proxy materials over the Internet and request to receive a paper copy of the proxy materials by mail, should they so desire. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the Notice. In addition, the Notice contains instructions on how you may request access to proxy materials in printed form by mail or electronically on an ongoing basis. The Notice is not a proxy card and cannot be used to vote your shares.

Our other shareholders, including shareholders who have previously requested to receive paper copies of the proxy materials and persons holding shares through our benefit plans, received paper copies of the proxy materials instead of the Notice. If you received paper copies of the Notice or proxy materials, we encourage you to sign up to receive all of your future proxy materials electronically, as described under “How can I receive my proxy materials by e-mail in the future?”below.

How can I access the proxy materials and vote my shares?

The instructions for accessing the proxy materials and voting can be found in the information you received either by mail or email. Depending on how you received the proxy materials, you may vote by Internet, telephone or mail. We encourage you to vote by Internet.

● | If you are a shareholder who received an email directing you to the proxy materials or a notice by mail regarding the Internet availability of the proxy materials, you may access the proxy materials and voting instructions over the Internet via the web address provided in the email or Notice. In order to access these materials and vote, you will need the 16-digit control number provided in the email or on the Notice. You may vote by following the instructions in the email, on the Notice or on the website. |

● | If you are a shareholder who received the proxy materials by mail, you may vote your shares by following the instructions provided on the proxy card or voting instruction form. If you vote by Internet or telephone, you will need the 16-digit control number provided on the proxy card or voting instruction form. If you vote by mail, please complete, sign and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed envelope. |

What does it mean if I receive more than one notice of Internet availability of proxy materials, proxy card, voting instruction form or email with instructions on how to access the proxy materials?

If you receive more than one notice of Internet availability of proxy materials, proxy card, voting instruction form or email with instructions on how to access the proxy materials, it means that you hold shares in more than one account. To ensure that all of your shares are voted, vote separately for each notice of Internet availability of proxy materials, proxy card, voting instruction form and email you receive.

How can I receive my proxy materials by email in the future?

Instead of receiving future paper copies of the Notice or our proxy materials by mail, you can elect to receive an email with links to these documents, your control number and instructions for voting over the Internet. Opting to receive your proxy materials by email will save the cost of producing and mailing documents to you and will also help conserve environmental resources.

If we mailed you a Notice or a printed copy of our proxy statement and annual report and you would like to sign up to receive these materials by email in the future, you can choose this option by:

● | Following the instructions provided on your proxy card or voting instruction form if you received a paper copy of the proxy materials; or |

● | Following the instructions provided when you vote over the Internet. |

Your election to receive future proxy materials by email will remain in effect until you revoke it.

Voting Information

What am I voting on?

● | Electing 12 directors to serve until the next Annual Meeting of Shareholders and until their respective successors are duly elected and qualified (Proposal 1); |

● | Ratifying the selection of FORVIS, LLP as the independent registered public accounting firm for Stock Yards Bancorp, Inc. for the year ending December 31, 2024 (Proposal 2); |

● | Approving a non-binding resolution to approve the compensation of the Company’s named executive officers, which we refer to as the say-on-pay proposal (Proposal 3); and |

● | Approving the amendment and restatement of our 2015 Omnibus Equity Compensation Plan, which includes an increase in the number of shares of common stock reserved and available for issuance (Proposal 4). |

Where can I find more information about these voting matters?

● | Information about the nominees for election as directors is contained in Proposal 1 beginning on page 16; |

● | Information about the ratification of the selection of FORVIS, LLP as the independent registered public accounting firm is contained in Proposal 2 on page 26; |

● | Information about the say-on-pay proposal is contained in Proposal 3 beginning on page 26; and |

● | Information about the proposed amendment and restatement of our 2015 Omnibus Equity Compensation Plan is contained in Proposal 4 beginning on page 27. |

Who is entitled to vote at the Annual Meeting?

Holders of record of Common Stock (“Common Stock”) of Stock Yards Bancorp as of the close of business on March 5, 20181, 2024 will be entitled to vote at the Annual Meeting. On March 5, 2018,1, 2024, there were 22,715,32229,366,737 shares of Common Stock outstanding and entitled to one vote on all matters presented for vote at the Annual Meeting.

How do I vote my shares?shares without participating in the Annual Meeting?

If you are a “record” shareholder of Common Stock (that is, if you hold Common Stock in your own name in Stock Yards Bancorp’sBancorp’s stock records maintained by our transfer agent), you may vote your shares without participating in the Annual Meeting by using one of the following three options.four options:

|

Use the Internet | |

| Call 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 p.m., Eastern Time, on April 24, 2024 for shares held directly and by 11:59 p.m., Eastern Time, on April 22, 2024 for shares held in a Plan. Have your Notice or proxy card in hand when you call and then follow the respective instructions. | |

| QR Code Scan the QR Code that appears on your Notice or proxy card to vote using your mobile device (mobile phone or tablet). | |

| If you |

|

|

|

|

Can I vote my shares during the meeting?

You may vote online during the meeting by logging into the virtual meeting web site with the 16-digit control number located on your Notice or email notice or, if you received a paper copy of the proxy materials, your proxy card or voting instruction form and following the on-screen instructions. You may also continue to vote your shares by mail, telephone, mobile device or Internet prior to the virtual meeting by following the voting instructions included in your proxy materials. If you have already voted using one of these methods you do not need to vote again at the meeting unless you wish to change your vote or revoke a previous proxy.

If my shares are held by my broker, will my broker vote my shares for me?

If your shares are held in a stock brokerage account or by a bank or other holder of record (that is, in “street name”), you are considered the beneficial owner of those shares. This Notice of Annual Meeting and Proxy Statement and any accompanying documents have been forwarded to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card provided by them or by following their instructions for voting by telephone, mobile device or over the Internet. Beneficial owners who wish to vote attheir shares electronically during the Annual Meeting will need to obtain amay do so by following the instructions from their broker that accompany their proxy form frommaterials.

Who votes the institution that holds your shares and to follow the voting instructions on such form.held in my Stock Yards KSOP account?

If you are a participant in the Stock Yards Bank & TrustTrust Company 401(k) and Employee Stock Ownership Plan (“KSOP”), you have the option of receiving your voting information either electronically or by regular postal mail. Plan participants who have elected to receive their voting information electronically should follow the instructions contained in the electronic communication. If you have not affirmatively elected to receive voting information for your KSOP shares electronically, you will receive a paper version of the proxy card via postal mail that will include the shares you own through that savings plan.your KSOP account. That proxy card will serve as a voting instruction card for the trustee of the plan. If you own shares through the plan and do not vote electronically or by mail, the plan trustee will be instructed by the plan’s administrative committee to vote the plan shares as the Board of Directors recommend.recommends.

What if I return my proxy card but do not provide voting instructions?

If you vote by proxy card, your shares will be voted as you instruct. If you return your proxy card but do not mark your voting instructions on your signed card, Mr. Heintzman,James A. Hillebrand, Chairman and Chief Executive Officer, and Mr. James A. Hillebrand,Philip S. Poindexter, President, as proxies named on the proxy card, will vote your shares FOR the election of the twelve12 director nominees, FOR the ratification of FORVIS, LLP, FOR the approval of the amendments to the 2015 Plansay-on-pay proposal and FOR the approval of the compensationamendment and restatement of the named executive officers.our 2015 Omnibus Equity Compensation Plan.

Can I change my vote after I have voted?

Yes. You may change your vote at any time before the polls close at the Annual Meeting. You may do this by:

● |

|

|

● | Voting again by telephone, mobile device or through the Internet prior to 11:59 p.m., Eastern Time, on April |

● | Giving written notice of revocation to our Corporate Secretary at 1040 East Main Street, Louisville, Kentucky 40206, prior to the |

● | Voting again |

Your attendance atparticipation in the Annual Meeting will not have the effect of revoking a proxy unless you notify our Corporate Secretary in writing before the polls close that you wish to revoke a previouspreviously submitted proxy.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have the discretionary authority to vote. This is called a “broker non-vote”.non-vote.” In these cases the broker can register your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange (“NYSE”) that govern brokers.

If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority to vote your shares on the ratification of FORVIS, LLP (Proposal 2) even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on the election of directors (Item(Proposal 1), the say-on-pay proposal (Proposal 3) or the approval of the amendments toamendment and restatement of the 2015 Omnibus Equity Compensation Plan (Item 2) or the approval of executive compensation (Item 3)(Proposal 4) without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

What constitutes a quorum for purposes of the Annual Meeting?

The presence at the Annual Meeting in person or by proxyHolders of a majority of the holders of more than 50 percent of the voting power of all outstanding shares of Common Stock entitled to vote shall constitute a quorumat the Annual Meeting must be present at the Annual Meeting or represented by proxy for the transaction of business. This is called a quorum. Proxies marked as abstaining (including proxies containing broker non-votes) on any matter to be acted upon by shareholders will be treated as present at the meeting for purposes of determining a quorum but will not be counted as votes cast on such matters. If a quorum is not present, we may propose to adjourn the meeting to solicit additional proxies and reconvene the meeting at a later date.

What vote is required to approve each item? Proposal?

You may vote “FOR” each nominee for director or “AGAINST” each nominee, or “ABSTAIN” from voting on one or more nominees. Unless you mark “AGAINST” or “ABSTAIN” with respect to a particular nominee or nominees or for all nominees, your proxy will be voted “FOR” each of the director nominees named in this Proxy Statement. A nominee will be elected as a director if the number of “FOR” votes exceeds the number of “AGAINST” votes.

The proposal to amendfollowing chart describes the 2015 Plan will pass if a majority of votes cast on the proposal are cast for approval of the amendment.

The proposal to approve the compensation of our named executive officers disclosed in this Proxy Statement will pass if votes cast for it exceed votes cast against it. Because this vote is advisory, it will not be binding upon Bancorp or the Board of Directors.

Any other itemproposals to be voted uponconsidered at the Annual Meeting, the vote required to elect directors and to approve each of the other proposals and the manner in which votes will passbe counted.

Proposals | Voting Options | Votes Required | Effect of Abstentions | Effect of Broker Non-Votes |

Proposal 1: Election of Directors | For, against or abstain for each nominee | Majority of votes cast | No effect | No effect |

Proposal 2: Ratification of our independent accountants for 2024 | For, against or abstain | Majority of votes cast | No effect | No effect |

Proposal 3: Approval of our executive compensation | For, against or abstain | Majority of votes cast | No effect | No effect |

Proposal 4: Approval of the amendment and restatement of our 2015 Omnibus Equity Compensation Plan | For, against or abstain | Majority of votes cast | No effect | No effect |

● | Proposal 1: Election of directors. Our Bylaws provide that a nominee for director in an uncontested election will be elected to our Board if the number of votes cast for the nominee’s election exceed the number of votes cast against his or her election. If a nominee does not receive the required votes for election at our Annual Meeting, our Board, with the assistance of our Nominating and Corporate Governance Committee, will consider whether to accept the director’s offer of resignation, which is required to be tendered under our Corporate Governance Guidelines. Our Board will publicly disclose its decision regarding the resignation and the basis for its decision within 90 days after election results are certified. |

● | Other proposals. Approval of Proposals 2, 3 and 4 requires that the votes cast in favor of each such proposal exceed the votes cast against the proposal. Because the say-on-pay vote (Proposal 3) is advisory, it will not be binding on the Company or our Board of Directors. |

What happens if votes cast forthe Annual Meeting is adjourned or postponed?

Your proxy will still be effective and will be voted at the rescheduled meeting in the same manner as it exceed votes cast against it.would have been voted at the originally scheduled meeting. You will still be able to change or revoke your proxy until it is voted.

Who counts the votes?

Broadridge Financial Solutions will count votes cast by proxy at the Annual Meeting. They will also certify the results of the voting and will also determine whether a quorum is present at the meeting. Any votes cast in person atelectronically during the Annual Meeting will be included in the final voting tally.

How are abstentions and broker non-votes treated?

You may abstain from voting on one or more nominees for director. You may also abstain from voting on any or all other proposals. Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but will not be counted in the number of votes cast for or against any nominee or with respect to any other matter. If a broker does not receive voting instructions from the beneficial owner of shares on a particular matter and indicates on the proxy that it does not have discretionary authority to vote on that matter, we will treat these shares as present at the meeting for purposes of determining a quorum but the shares will not count as votes cast on the matter. Abstentions and broker non-votes will not affect the outcome of any matters to be voted on at the Annual Meeting.

What information do I need to attend the Annual Meeting?

We do not use tickets for admission to the Annual Meeting. If you are voting in person, we may ask for photo identification.

How does the Board recommend that I vote my shares?

The Board recommends a vote FOR each of the nominees for director set forth in this document, Proxy Statement, FOR the ratification of the selection of the independent registered accounting firm, FOR the approval of the amendments to the 2015 Plansay-on-pay proposal, and FOR the approval of the compensationamendment and restatement of the named executive officers.2015 Omnibus Equity Compensation Plan.

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion in the best interests of Stock Yards Bancorp. At the date this Proxy Statement went to press, the Board of Directors had no knowledge of any business other than that described herein that would be presented for consideration at the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are kept confidential from our management and Board of Directors to protect your voting privacy. We will not disclose the proxy voting instructions or ballots of individual shareholders unless disclosure is required by law and in certain other limited circumstances. If you write comments on your proxy card, the card may be forwarded to our management and Board of Directors to review your comments.

Who will bear the expense of soliciting proxies?

Stock Yards Bancorp will bear the cost of soliciting proxies in the form enclosed. In addition to the solicitation by mail, proxies may be solicited personally or by telephone, facsimile or electronic transmission by our employees. We reimburse brokers holding Common Stock in their names or in the names of their nominees for their expenses in sending proxy materials to the beneficial owners of such Common Stock. The Company has engaged the services of Laurel Hill Advisory Group, LLC.,LLC, a professional proxy solicitation firm, to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. The Company’s costsCompany’s cost for such services will not exceed $7,500be $8,500 plus reasonable out of pocket expenses.

Is thereHow can I find the voting results of the Annual Meeting?

Preliminary results will be announced at the Annual Meeting. Final results will be published in a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

Virtual Meeting Information

Why are you holding a virtual meeting instead of a physical meeting?

The Annual Meeting will be conducted in an online, virtual-only format. This format enables us to leverage technology to communicate more efficiently with our shareholders. We can provide a consistent experience for all our shareholders regardless of geographic location and allow all shareholders with Internet access to attend and participate in the meeting without the cost of travel. We have designed the virtual meeting format to provide the same participation opportunities as were provided at our past in-person meetings, including the ability to vote your shares and ask questions during the meeting.

How do I participate in the meeting?

To participate in the virtual meeting, visit www.virtualshareholdermeeting.com/SYBT2024 and enter the 16-digit control number located on your Notice or email notice or, if you received a paper copy of the proxy materials, your proxy card or voting instruction form. You may log into the meeting platform beginning at 9:45 a.m., Eastern Time, on April 25, 2024. The live audio webcast will begin promptly at 10:00 a.m., Eastern Time. We encourage shareholders to access the virtual meeting web site prior to the start of the meeting and to allow sufficient time to complete the online registration process.

What are the technical requirements for accessing the online meeting site?

The virtual meeting platform is fully supported across browsers (Microsoft Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and mobile phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the meeting. Participants should also give themselves ample time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

Will I have an opportunity to submit a question?

Yes, shareholders will have the opportunity to submit questions if they choose. If you wish to submit a question, you may do so in two ways. If you want to ask a question before the meeting, you may log into www.proxyvote.com and enter your 16-digit control number. Next, click on “Question for Management,” type in your question and click “Submit.” Alternatively, if you want to submit your question during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/SYBT2024, type your question into the box titled “Ask a Question” on the meeting screen and click “Submit.” Shareholders may choose from a list of optional question topics or enter their own live question in the box provided. Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered together.

Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. Shareholders should refer to the Rules of Conduct and Procedures for the meeting that will be posted on the virtual meeting web site for guidelines regarding the submission of questions, including certain topics and subject matter that we will consider inappropriate for purposes of the meeting. Any questions pertinent to meeting matters that cannot be answered during the meeting due to time constraints will be posted online and answered at www.syb.com. The questions and answers will be available as soon as practical after the meeting and will remain available until one week after posting.

What if I have lost or misplaced my 16-digit control number?

If you no longer have your control number or were not a shareholder on March 1, 2024, you may still enter the meeting as a guest in listen-only mode. To access the meeting as a guest, visit www.virtualshareholdermeeting.com/SYBT2024 and enter the requested information on the welcome screen. However, if you attend the meeting as a guest, you will not have the ability to vote or submit questions.

What if I experience technical difficulties accessing the meeting?

If you encounter any technical difficulties with the virtual meeting platform, please use the telephone numbers listed on the meeting web site prior to the start of the meeting and technicians will be available to assist you.

What will happen if we experience technical problems during the meeting webcast?

In the event of technical difficulties or interruptions with the Annual Meeting, we expect that an announcement will be made on the meeting website, www.virtualshareholdermeeting.com/SYBT2024. If necessary, the announcement will provide updated information thatregarding the date, time and location of the Annual Meeting. Any updated information regarding the Annual Meeting will also be posted to the investor relations page on our website, www.syb.com.

Shareholder Proposals and Director Nominations

Can I should know about future annual meetings?submit a proposal (other than a director nomination) for consideration at the 2025 Annual Meeting?

Any shareholder who intends to present a proposal at the 20192025 Annual Meeting of Shareholders must deliver the proposal to the Corporate Secretary at 1040 East Main Street, Louisville, Kentucky 40206the address provided below no later than November 23, 2018,14, 2024 if the proposal is submitted for inclusion in our proxy materials for that meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934. In addition, our Bylaws impose certain advance notice requirements onFor a shareholder nominatingproposal that is submitted for presentation directly at the 2025 Annual Meeting but not intended to be included in our proxy materials under Rule 14a-8, the shareholder must give timely notice to our Corporate Secretary and otherwise comply with the applicable requirements of our Bylaws. Our Bylaws require that notice of a director or submitting ashareholder proposal to an Annual Meeting. Such notice must be submitted to thereceived by our Corporate Secretary of Stock Yards Bancorp no later than January 25, 2019. The notice must24, 2025 and contain the information prescribed by the Bylaws, copies of which are available from the Corporate Secretary. These requirements apply even if

How may I nominate individuals to serve as directors at the 2025 Annual Meeting?

Our Bylaws permit shareholders to nominate directors for consideration at an annual meeting. A shareholder desiring to present a director nomination directly at an annual meeting must provide the information required by our Bylaws and give timely notice of the nomination to our Corporate Secretary in accordance with our Bylaws. To nominate a director for consideration at the 2025 Annual Meeting of Shareholders, the notice must be received by our Corporate Secretary at the address provided below no later than January 24, 2025, and contain the information required by our Bylaws.

Further, the deadline for providing notice to the Company under Rule 14a-19, the SEC’s universal proxy rule, of a shareholder’s intent to solicit proxies on the Company’s proxy card in support of director nominees submitted in accordance with the advance notice provisions of our Bylaws for the 2025 Annual Meeting of Shareholders is February 24, 2025. This deadline under Rule 14a-19 does not desiresupersede or replace any of the timing requirements for advance notice under our Bylaws. The supplemental notice and information required under Rule 14a-19 is in addition to have his or her nomination or proposal includedthe advance notice requirements of our Bylaws and does not extend the deadline specified in the Bylaws.

All shareholder proposals, director nominations and requests for copies of our Proxy Statement.Bylaws should be addressed as follows:

Stock Yards Bancorp, Inc.

Executive Offices

1040 E. Main Street

Louisville, Kentucky 40206

Attn: Corporate Secretary

CORPORATE GOVERNANCE AND RELATED MATTERS

Corporate Governance Highlights

Our Board of Directors and management are committed to strong corporate governance practices, which we believe support our dedication to managing the Company’s business in a responsible and ethical manner and promote long-term shareholder value. Highlights of our governance structure and practices include the following:

Board Independence

● | Strong Lead Independent Director |

● | Substantial majority of independent directors |

● | All Board committees are comprised entirely of independent directors |

● | Executive sessions of non-management directors at Board and committee meetings |

Board Accountability

● | Annual elections for all directors |

● | Majority voting in uncontested director elections combined with a director resignation policy |

● | Mandatory director retirement policy |

● | Board focus on strategic planning and direction, including annual reviews of the Company’s strategic objectives and plans |

● | No poison pill |

Board Effectiveness

● | Annual Board and committee assessments, including one-on-one discussions between the Lead Independent Director and each other non-management director |

● | Strong corporate governance guidelines |

● | Comprehensive onboarding program for new directors |

● | Ongoing training and educational opportunities for directors |

Shareholder Alignment

● | Robust stock ownership requirements for directors and executive management |

● | Policies that prohibit our directors and executive officers from hedging or pledging Stock Yards Bancorp stock |

Shareholder Feedback and Engagement

Our Board of Directors values and respects the views and feedback we receive from our shareholders through voting results at our annual shareholder meetings or from other forms of engagement. One of the nominees for director at our 2023 Annual Meeting, David P. Heintzman, received a substantial number of votes cast against his election. Mr. Heintzman is the retired Chairman and Chief Executive Officer of the Company and the Bank and has served on the Boards of Directors of both entities since 1992. He retired from his executive positions with the Company and the Bank in 2018.

The Nominating and Corporate Governance Committee of the Board of Directors meets annually to review voting results from the most recent annual meeting of shareholders and consider any governance-related issues presented by the voting totals. At its July 2023 meeting, the Committee noted the final voting results for Mr. Heintzman and discussed the apparent reasons for the significant number of votes cast against his election. Based upon feedback received from some of our larger institutional shareholders and the voting recommendations published by one of the major proxy advisory firms, we believe the final results for Mr. Heintzman were significantly influenced by his service on the Audit Committee of the Board of Directors and, in their views, his status as a non-independent director. Unlike the Nasdaq listing standards which consider former CEOs to be independent after a three-year “cooling off” period, these investors and proxy firms view former CEOs as non-independent. Mr. Heintzman began serving on the Audit Committee in April 2022. We understand their policies are to vote, or recommend a vote, against the election of non-independent directors who serve on key board committees such as the Audit Committee.

The Nominating and Corporate Governance Committee discussed the voting results for Mr. Heintzman and the apparent reason behind those results and concluded that it would be advisable to reassign him from the Audit Committee to the Trust Committee, effective immediately. Mr. Heintzman’s service on the Audit Committee ended in July 2023.

Role of the Board and Governance Principlesof Directors

The Stock Yards Bancorp’s Board of Directors represents shareholders’ interests in perpetuating a successful business including optimizing shareholder returns. The Directors are responsible for determining that the Company is managed to ensure this result. This is an active responsibility, and the Board monitors the effectiveness of policies and decisions including the execution of the Company’s business strategies. Strong corporate governance guidelines form the foundation for Board practices. As a part of this foundation, the Board believes that high ethical standards in all Company matters are essential to earning the confidence of investors, customers, employees and vendors. Accordingly, Stock Yards Bancorp has established a framework that exercises appropriate measures of oversight at all levels of the Company and clearly communicates that the Board expects all actions be consistent with its fundamental principles of business ethics and other corporate governance guidelines.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that provide the framework for how the Board conducts its business and fulfills its duties and responsibilities. The Company’s governance guidelinesCorporate Governance Guidelines address board responsibilities, director independence, the role of the Lead Independent Director, director qualifications, stock ownership requirements and other related mattersBoard structures and practices intended to enhance the Board’s effectiveness. Under the leadership and oversight of the Nominating and Corporate Governance Committee, the Corporate Governance Guidelines are publishedreviewed annually in light of recent governance trends and developments, best practices and changes in applicable laws and regulations. The Corporate Governance Guidelines are available on the Company website: www.syb.com underinvestor relations page of the Investor Relations tab.Company’s website, www.syb.com.

The Board of Directors believes the most effective leadership structure for the Company at the present time is a combinedto combine the roles of Chairman of the Board and Chief Executive Officer. Our current Chief Executive Officer, James A. Hillebrand, was appointed to the additional position filled byof Chairman of the Board effective January 1, 2021. Mr. Heintzman. HeHillebrand has a long history of service in various management capacities with the Bank, is the director mostvery familiar with theits business, of the Companyits customers and the banking industry generally, and the community bank model in particular. The Board believes that he is best suitedhighly qualified to lead discussions on important strategic and operational issues affecting the Bank and Bancorp. Combining the Chief Executive Officer and Chairman positions creates a firm link between management and the Board and promotes development and implementation of corporate strategy. AsThe Board also believes that the industry knowledge and experience provided by Mr. Hillebrand as our Chief Executive Officer, together with our strong lead independent director, Stephen M. Priebe, and our experienced committee chairs and other directors, will enable the Company to continue to meet the expectations of our shareholders and provide strong independent oversight from our directors.

The Board does not have a fixed policy on whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. The Company’s corporate governance documents address the leadership structure of the Board and the respective roles of the Chairman of the Board and the Chief Executive Officer. The Board will annually elect one of its members to serve as Chairman of the Board. The Chairman will preside at all meetings of the shareholders and of the Board of Directors, and generally consult with the Board on matters pertaining to the Company’s business and affairs. Both positions may, but need not, be held by the same person. The decision as to whether the offices of Chairman of the Board and Chief Executive Officer should be combined or separated will be made from time to time by the Board of Directors at its discretion. The Board’s decision will be made in its business judgment and based upon its consideration of all relevant factors and circumstances at the time, including the specific needs of the Company’s business, the strengths of the individual or individuals holding those positions and the current composition of the Board. We would notify shareholders promptly of a decision by the Board to separate the roles of Chairman of the Board and Chief Executive Officer.

If the individual elected as Chairman of the Board is committed to strong corporate governance practices,also the Chief Executive Officer, or if the Chairman of the Board has designatedis not an independent director, the Board will elect a lead independent director. director to help ensure strong independent leadership on the Board.

In addition to an independent lead director, threefive committees of the Board provide independent oversight of management – the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee, the Credit and Risk Committee and the Trust Committee. Each is composed entirely of independent directors.

TheIf a lead independent director is called for under the Company’s governance documents, the Chair of the Nominating and Corporate Governance Committee (currently Charles R. Edinger III) acts in the role of lead director. Thethat role. Stephen M. Priebe currently serves as lead director presidesbecause Mr. Hillebrand, as the current Chief Executive Officer of the Company, does not qualify as an independent director under the Board’s independence standards. The role and responsibility of the lead director consists of the following:

● | preside at executive sessions of the Board, which consist of independent and non-management directors and are held at least two times annually; |

● | call special meetings of the independent directors and committees of the Board; |

● | serve as a liaison between the Chief Executive Officer and board members and be available to discuss with any director concerns he or she may have regarding the Board, the Company or the management team; |

● | provide advice and consultation to the Chief Executive Officer and inform him or her of decisions reached and suggestions made during executive sessions of the Board of Directors; |

● | review and approve matters such as agendas and schedules for Board meetings and executive sessions, and information distributed to board members; and |

● | consult and communicate with shareholders where appropriate. |

Committees of the Board which consist of non-management directors and are held at least four times annually. He has authority to call special meetings of the independent directors and committees of the Board, serves as liaison between the Chairman and board members and is available to discuss with any director concerns he or she may have regarding the Board, the Company or the management team. The lead independent director is responsible for providing advice and consultation to the Chairman and Chief Executive Officer and informing him of decisions reached and suggestions made during executive sessions of the Board of Directors. The lead director reviews and approves matters such as agendas for Board meetings and executive sessions, and information distributed to board members.

Board Evaluation Process

The Board conducts an annual self-assessment to enhance its effectiveness. Through regular evaluation of its policies, practices and procedures, the Board identifies areas for further consideration and improvement. The evaluation process is led by the Nominating and Corporate Governance Committee. Each director is requested to complete a questionnaire and provide feedback on a range of issues, including his or her assessment of the Board’s overall effectiveness and performance; its committee structure; priorities for future Board discussion and attention; the composition of the Board and the background and skills of its members; the quality, timing and relevance of information received from management; and the nature and scope of agenda items. The lead director then meets with each director individually to discuss his or her questionnaire responses and any other thoughts or suggestions the director may have regarding the Board’s overall effectiveness or specific Board practices or policies. The lead director prepares a summary of findings drawn from the questionnaire responses and director interviews for presentation to the full Board of Directors. Each of the Committees also conducts their own self-assessments led by the committee chairs.

Board Oversight of Risk Management

The Board of Directors has a significant role in the oversight of risk management. The Board receives information regarding risks facing the Company, their relative magnitude and management’s plan for mitigating these risks. Primary risks facing the Company are credit, operational, interest rate, liquidity, compliance/legal, strategic and reputational risks. After assessment by management, reports are made to committees of the Board. Credit risk is addressed by the Bank’s Risk Committee. Operational and compliance/legal risks are addressed by the Audit Committee of Bancorp and the Bank’s Risk Committee. Interest rate and liquidity risks are addressed by the Asset/Liability Committee comprised of Bank management and reports are made monthly to the Board. Strategic and reputational risk is addressed by the above committees in addition to the Compensation Committee of Bancorp along with other executive compensation matters. Oversight of the trust department is addressed by the Trust Committee of the Bank. Corporate governance matters are addressed by the Nominating and Corporate Governance Committee of Bancorp. The full Board hears reports from each of these committees at the Board meeting immediately following the Committee meeting. The Bank’s Director of Internal Audit has a direct reporting line to the Audit Committee of the Board. The Chief Risk Officer, Information Security Officer and Compliance Officer make regular reports to the Audit and Risk Committees and the full Board when appropriate. During 2016, the Risk Committee assumed oversight responsibility for a broader range of enterprise-related risks within the Bank and has become the primary board level committee focused on risk management and related policies and processes.

Shareholder Communications with the Board of Directors

Shareholders may communicate directly to the Board of Directors in writing by sending a letter to the Board at: Stock Yards Bancorp Board of Directors, P.O. Box 32890, Louisville, KY 40232-2890. Communications directed to the Board of Directors will be received by the Chairman and processed by the Nominating and Corporate Governance Committee when the communications concern matters related to the duties and responsibilities of the Board of Directors.

BOARD OF DIRECTORS’ MEETINGS AND COMMITTEES

During 2017, the Board of Directors of Stock Yards Bancorp held thirteen regularly scheduled meetings. All directors of Stock Yards Bancorp are also directors of the Bank. During 2017, the Bank’s Board of Directors also held thirteen regularly scheduled meetings.

All directors attended at least 75% of the number of meetings of the Board and committees of the Board on which they served that were held during the period he or she served as a director. All directors are encouraged to attend annual meetings of shareholders, and ten of eleven attended the 2017 Annual Meeting.

Stock Yards Bancorp hasmaintains an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee and a Credit and Risk Committee of the Board of Directors. The Bank has a Risk Committee andmaintains a Trust Committee of the Board of Directors. Each of these committees operates under a written charter approved by the Board of Directors and reviewed annually by the committee. The chair of each committee reports its activities, discussions, recommendations and approvals to the full Board at each regularly scheduled Board meeting. Committee leadership and membership is reviewed annually by the Nominating and Corporate Governance Committee and, upon its recommendations, approved by the Board. The charters are available on the investor relations page of our website, www.syb.com. Current members of each of these committees are identified below.

Director | Audit Committee | Compensation Committee | Nominating And Corporate Governance Committee | Credit and Risk Committee | Trust Committee |

Shannon B. Arvin | ✔ | Chair | |||

Paul J. Bickel III | ✔ | ✔ | |||

Allison J. Donovan | ✔ | ✔ | |||

David P. Heintzman | Chair | ✔ | |||

Carl G. Herde (1) | Chair | ✔ | |||

James A. Hillebrand (3) | |||||

Richard A. Lechleiter (1) | ✔ | Chair | |||

Philip S. Poindexter (3) | |||||

Stephen M. Priebe (2) | ✔ | Chair | |||

Edwin S. Saunier | ✔ | ✔ | |||

John L. Schutte | ✔ | ✔ | |||

Laura L.Wells | ✔ | ✔ |

(1)Audit Committee Financial Expert

(2)Lead Independent Director

(3)Messrs. Hillebrand and Poindexter are management directors and do not serve on any Board committees.

Audit Committee

The Board of Directors of Stock Yards Bancorp maintains an Audit Committee comprised of directors who are not officers of Stock Yards Bancorp. For 2017,Each member of the Audit Committee was comprised of Messrs. Herde (Chairman), Lechleiter and Priebe and Ms. Heitzman. Each of these individuals meets the SECSecurities and NASDAQExchange Commission (“SEC”) and Nasdaq independence requirements for membership on an audit committee and each is financially literate within the meaning of the NASDAQNasdaq listing rules. The Board of Directors has adopted a written charter for the Audit Committee, and this charter is available on Stock Yards Bancorp’s website: www.syb.com.

The Audit Committee oversees Stock Yards Bancorp’sthe Company’s financial reporting process on behalf of the Board of Directors. Management has primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee, among other things, considers the appointment of the external auditors for Stock Yards Bancorp, reviews with the auditors the plan and scope of the audit and audit fees, monitors the adequacy of reporting and internal controls, meets regularly with internal and external auditors, reviews the independence of the external auditors, reviews Stock Yards Bancorp’s financial results as reported in Securities and Exchange Commission filings, and approves all audit and permitted non-audit services performed by its external auditors. The Committee reviews and evaluates identified related party transactions and discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor and control those exposures. matters,

● | considers the appointment of our external auditors, |

● | reviews with the auditors the plan and scope of the audit and audit fees, |

● | monitors the adequacy of reporting and internal controls, |

● | meets regularly with internal and external auditors, |

● | reviews the independence of the external auditors, |

● | reviews our financial results as reported in SEC filings, |

● | approves all audit and permitted non-audit services performed by our external auditors, |

● | reviews and evaluates identified related party transactions, and |

● | discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor and control those exposures. |

The Audit Committee meets with our management at least quarterly to consider the adequacy of our internal controls and the objectivity of our financial reporting. This Committee also meets with the external auditors and with our internal auditors regarding these matters. Both the independent auditors and the internal auditors regularly meet privately with this Committee and have unrestricted access to this Committee.

The Audit Committee held five meetings during 2017.2023.

The Board of Directors has determined that Messrs. Herde and Lechleiter and Ms. Heitzman are audit committee financial experts for Stock Yards Bancorp and are independent as described in the paragraph above. SeeWe refer you to the section captioned “REPORT OF THE AUDIT COMMITTEE” on page 73 of this Proxy Statement for more information.information about the role and responsibility of the Audit Committee in the Company’s financial reporting process.

Nominating and Corporate Governance Committee

The Board of Directors of Stock Yards Bancorp maintains a Nominating and Corporate Governance Committee. MembersEach member of thisthe Nominating and Corporate Governance Committee are Messrs. Brown, Edinger (Chairman) and Northern, all of whom are non-employee directors meetingmeets the NASDAQNasdaq independence requirements for membership on a nominating and governance committee. Responsibilities of the Committee are set forth in a written charter satisfying the NASDAQ’sNasdaq’s corporate governance standards, requirements of federal securities law and incorporating other best practices.

The Board of Directors has adopted a written charterCommittee’s primary duties and responsibilities consist of:

● | identifying and evaluating candidates for election to the Board of Directors, including consideration of candidates suggested by shareholders; |

● | developing a Board succession strategy; |

● | assisting the Board in determining the structure, leadership and composition of Board committees; |

● | monitoring the Board’s effectiveness; |

● | developing and implementing the Company’s corporate governance guidelines; |

● | establishing stock ownership guidelines for non-management directors and annually assessing directors’ ownership relative to those guidelines; |

● | developing and overseeing an annual self-evaluation process for the Board and its committees; and |

● | reviewing the Company’s policies, practices and disclosures with respect to environmental, social and governance, or ESG, matters. |

The Nominating and Corporate Governance Committee and this charter is available on Stock Yards Bancorp’s website: www.syb.com.

Among the Committee’s duties are identifying and evaluating candidates for election to the Board of Directors, including consideration of candidates suggested by shareholders. To submit a candidate for consideration by the Committee, a shareholder must provide written communication to the Committee. The Committee would apply the same board membership criteria to shareholder-nominated candidates as it would to Committee-nominated candidates. The Committee also assists the Board in determining the composition of Board committees, assessing the Board’s effectiveness and developing and implementing the Company’s corporate governance guidelines. This Committee held three meetings during 2017.2023.

Compensation Committee

The Board of Directors of Stock Yards Bancorp maintains a Compensation Committee. MembersEach member of thisthe Compensation Committee are Messrs. Edinger, Lechleiter (Chairman) and Tasman, all of whom meetmeets the NASDAQNasdaq independence requirements for membership on the Compensation Committee. The Board of Directors has adopted a written charter for the Compensation Committee, and this charter is available on Stock Yards Bancorp’s website: www.syb.com. The responsibilities of this Committee include oversight of executive and Board compensation and related programs. We refer you to the section captioned “REPORT ON EXECUTIVE COMPENSATION” beginning on page 40 of this Proxy Statement for more information about the role and responsibilities of the Compensation Committee in our executive compensation program and its activities during 2023.

The Compensation Committee held sixeight meetings during 2017. See “EXECUTIVE COMPENSATION AND OTHER INFORMATION - REPORT ON EXECUTIVE COMPENSATION” for more information.2023.

Credit and Risk Committee Committee

The Board of Directors of Stock Yards BankBancorp maintains a Credit and Risk Committee. This Committee is responsible for overseeing and monitoring management’s implementation and enforcement of the Bank’s commercialframework for risk management throughout the organization. The Committee’s primary duties and consumer loan portfolio and the related credit risk. responsibilities consist of:

● | monitoring and advising the Board of matters specific to the Bank’s risk exposures, including credit, cyber/information security and compliance/legal risks; |

● | reviewing reports of examination by regulatory agencies and reviewing and observations or communications by regulatory agencies, and the results of internal and third party testing, analyses and reviews, related to the Bank’s risks, risk management or any other matters within the scope of the Committee’s oversight responsibilities; |

● | reviewing items as mandated by regulatory agencies, which may include annual reviews of information security, physical security and the BSA/AML program; and |

● | assisting the Board in overseeing and supervising all aspects of the Bank’s compliance with the Community Reinvestment Act (“CRA”) and fair lending. |

The Committee reviews and discusses with management its assessment of asset quality and trends in asset quality, credit quality administration and underwriting standards and the effectiveness of portfolio risk management systems. The Committee is also responsible for reviewing and approving significant lending and credit policies and compliance with those policies. During 2016,Additionally, the Risk Committee significantly expanded its duties to includehas oversight responsibility for a widerwide range of enterprise-related risks within the Bank, including regulatory compliance, information security, cybersecurity, fraud, insurance and physical security. Members of this Committee are Messrs. Bickel, Edinger, Northern (Chairman)

The Credit and Tasman. The Risk Committee held twelvesix regular meetings in 2017.2023.

Trust Committee

The membersBoard of the Bank’sDirectors of Stock Yards Bank maintains a Trust Committee are Messrs. Bickel, Brown, Herde and Priebe and Ms. Heitzman. This Committee held six meetings in 2017.Committee. The Trust Committee oversees the operations of the wealth management and trust department of the Bank to help ensure it operates in accordance with sound fiduciary principles and is in compliance with pertinent laws and regulations. The Committee’s primary duties and responsibilities consist of:

● | approving written policies to govern the conduct of the Bank’s fiduciary and trust activities; |

● | monitoring the proper implementation of policies, procedures and guidelines established for the activities and operations of the wealth management and trust department; |

● | reviewing business development reports and overseeing the development and growth of new wealth management and trust business; |

● | reviewing regular reports from management concerning investment performance and significant changes in recommended assets for applicable investment accounts; and |

● | reviewing audit and examination reports. |

The Trust Committee held four meetings in 2023.

ITEM Non-management Executive Sessions

The non-management members of the Board of Directors meet in executive session at least twice each year following the regularly scheduled Board meeting, and more frequently if necessary or appropriate. The Lead Independent Director presides over these executive sessions. The executive sessions provide an opportunity for the directors to discuss topics such as business results and performance, executive leadership and succession, critical strategic matters and other matters outside the presence of management. Board committees also have the opportunity to meet in executive session without management if they choose to do so.

The Board conducts an annual self-assessment to enhance its effectiveness. Through regular evaluation of its policies, practices and procedures, the Board identifies areas for further consideration and improvement. The evaluation process is led by the Nominating and Corporate Governance Committee. Each year, that Committee discusses and decides upon the process to be followed for the upcoming year. Each director may be requested to complete a questionnaire and provide feedback on a range of issues, including his or her assessment of the Board’s overall effectiveness and performance; its committee structure; priorities for future Board discussion and attention; the composition of the Board and the background and skills of its members; the quality, timing and relevance of information received from management; the nature and scope of agenda items; and his or her individual contributions to the Board. The lead director then meets with each director individually either to discuss his or her questionnaire responses or, if directors were not requested to complete a questionnaire, to discuss thoughts and suggestions the director may have regarding the Board’s overall effectiveness or specific Board practices or policies. The lead director prepares a summary of findings drawn from the questionnaire responses and director interviews for presentation to the full Board of Directors. Each of the Committees also conducts their own self-assessments led by the respective committee chairs. Based upon comments from Board members during the 2023 evaluation process, the Board enhanced its ongoing director education program to include more presentations from key market and line of business managers, among other matters.

LECTION OF Director Onboarding and Continuing Education

We provide a comprehensive orientation and onboarding program for new directors and ongoing education and training for all Board members on key matters related to our Company and the banking industry generally, all designed to enhance the overall knowledge and effectiveness of our Board. The onboarding process for new directors involves a combination of written materials, management presentation and meetings with members of the Board, including our lead director, and senior management. Among the topics typically covered during orientation are Company history, corporate governance, financial and investor relations matters, risk management and compliance, corporate strategy and key lines of business.

We provide regular educational and training sessions for all directors throughout the year. Topics covered during these sessions may include required training and updates on bank-related compliance matters such as extensions of credit to insiders (Regulation O), fair lending responsibilities and Bank Secrecy Act/Anti-Money Laundering issues. Additional subjects may include in-depth presentations from management on key products, services or lines of business, strategic planning initiatives and market overviews and presentations from outside advisors on emerging trends and developments affecting the banking and financial services industry, including updates on current regulatory, economic, strategic, investor and capital markets issues.

TWELVECodes of Conduct and Ethics

We require all of our officers and employees and, when applicable, our directors to accept and abide by our Code of Business Conduct and Ethics, or the “Code of Conduct”. The Code of Conduct reinforces our Company’s commitment to the highest standards of ethical business practices and compliance with all applicable legal requirements, and sets forth expectations for the use and protection of proprietary business and customer information and relationships with our employees, customers, vendors and the public, among other matters. Our Chief Executive Officer, President, Chief Financial Officer, Principal Accounting Officer, Controller and other financial officers are also subject to a Code of Ethics which supplements our general Code of Conduct. We will promptly disclose any amendment or waiver with respect to the financial Code of Ethics in accordance with the applicable rules of the SEC and Nasdaq.

All of our directors, officers and employees are required to annually affirm in writing their continued understanding of and compliance with our Code of Conduct. Employees receive regular quarterly reminders of our “Do the Right Thing” policy and their responsibility to report questionable business practices that could be violations of law or breaches of our Code of Conduct. Employees are encouraged to report their concerns on a confidential basis either directly to a designated company employee or to a representative of an independent third party firm.

DIRECTORSBoard Oversight of Risk Management

The Board of Directors presently consistshas a significant role in the oversight of twelve members. risk management. The Board receives information regarding risks facing the Company, their relative magnitude and management’s plan for mitigating these risks. Primary risks facing the Company are credit, operational, cybersecurity and informational security, interest rate, liquidity, compliance/legal, strategic and reputational risks. After assessment by management, reports are made to committees of the Board. Credit risk is addressed by the Risk Committee of Bancorp. Operational and compliance/legal risks are addressed by the Audit Committee and the Risk Committee of Bancorp. Cybersecurity and informational security risks are addressed by the Risk Committee of Bancorp. Interest rate and liquidity risks are addressed by the Asset/Liability Committee comprised of Bank management and reports are made to the Board at each of its regular meetings. Strategic and reputational risk is addressed by the above committees in addition to the Compensation Committee of Bancorp along with other executive compensation matters. Oversight of the trust department is addressed by the Trust Committee of the Bank. Corporate governance matters are addressed by the Nominating and Corporate Governance Committee of Bancorp. The full Board receives reports from each of these committees at the Board meeting immediately following the Committee meeting. The Bank’s Director of Internal Audit has a direct reporting line to the Audit Committee of the Board. The Chief Risk Officer, Information Security Officer and Compliance Officer make regular reports to the Audit and Risk Committees and the full Board when appropriate.

During 2023, the Board of Directors of Stock Yards Bancorp held eight regularly scheduled meetings. All directors of Stock Yards Bancorp are also directors of the Bank. During 2023, the Bank’s Board of Directors also held eight regularly scheduled meetings.

All directors attended at least 75% of the number of meetings of the Board and committees of the Board on which they served that were held during the period he or she served as a director. All directors are encouraged to attend annual meetings of shareholders, and all attended the 2023 Annual Meeting except Ms. Arvin.

Shareholder Communications with the Board of Directors

Shareholders may communicate directly to the Board of Directors in writing by sending a letter to the Board at: Stock Yards Bancorp Board of Directors, P.O. Box 32890, Louisville, KY 40232-2890. Communications directed to the Board of Directors will be received by the Chairman and processed by the Nominating and Corporate Governance Committee when the communications concern matters related to the duties and responsibilities of the Board of Directors.

Stock Yards Bank is a community bank built on strong core values of trust, character, integrity, sound judgment, personal accountability and respect for others. We are committed to serving our customers’ needs and helping them to achieve their financial goals. Likewise, we are committed to being a good neighbor and investing in the communities in which we live and work, and to supporting our fellow team members by cultivating a healthy work environment in which they can grow and succeed together and individually. This means providing the products and services necessary to help our individual customers and their families reach their financial goals, assisting our business customers to grow and expand their businesses and extending access to banking and financial resources to all segments of our communities, including the underbanked. We recognize that environmental, social and governance (“ESG”) principles are important to delivering on those commitments and maintaining our core values.